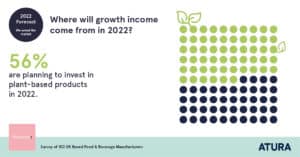

New research commissioned by Atura Proteins [1], reveals food and drink brand owners and manufacturers are most likely (56 per cent) to invest their new product development budgets in the development of plant-based products in 2022.

Broadening product ranges to appeal to flexitarians i.e., those who eat a plant-based diet without eliminating meat completely (48 per cent), and vegans (47 per cent) was the most common reason for plant-based investment, with interest from retail customers and environmental concerns both on par (36 percent).

Of the 102 UK-based food and drink professionals surveyed, four in ten (41 per cent) believe that meat alternatives, plant-based substitutes for meat such as mince, will be the biggest growth category for plant-based foods, followed by cereals (13 per cent) and cheese (12 per cent).

A third of industry professionals (34 per cent) claim that difficulty of sourcing ingredients is the biggest barrier to developing plant-based products. More than a quarter (29 per cent) claimed the biggest barrier was consumer resistance related to taste and formulation issues.

The research suggests that plant-based is a big priority for professionals in the food and drink industry, tapping into evolving vegetarian, flexitarian and vegan consumer diets. The increase in demand presents a significant opportunity for food and beverage brands. The survey also suggests that decision makers may have challenges sourcing some plant-based ingredients which may reflect the supply chain pressures brought about by increasing demand.

“The plant-based food market is expected to grow at a CAGR of 11.9% from 2020 to 2027[2], and there are now an estimated 8.7 million flexitarians in the UK[3], so it’s a great time for businesses to think about tapping into the market.”

Furthermore, with protein fortification high on the agenda, incorporating plant protein to deliver a source of protein claim is important for product formulators. More than half (55 per cent) of decision makers confirmed that developing protein fortified products typically came in response to demand from more health-conscious consumers.

Protein is enduring in its popularity and the trend towards protein fortification shows no sign of slowing. Coupled with the trend towards plant-based, food and drink manufacturers, there is a real opportunity to consider alternative protein sources, like fava beans, chickpea and red lentils, to help deliver optimal food and beverage products for consumers.

For more information on the new ATURA research please contact us: info@aturaproteins.com

[1] Survey of 102 food and beverage decision makers in the UK, conducted by Savanta in October 2021

[2] https://www.researchandmarkets.com/reports/5144605/plant-based-food-market-by-product-type-dairy?utm_source=CI&utm_medium=PressRelease&utm_code=8bdlgv&utm_campaign=1523437+-+Global+Plant+Based+Food+Market+Report+2020-2027%3a+Rising+Industry+Concentration+with+Growth+in+Mergers+and+Acquisitions+in+the+Plant-Based+Products+Space&utm_exec=chdo54prd

[3] YouGov survey estimates 13% of UK population are flexitarians. ONS Survey estimates UK population is 67 million. 13% of 67m = 8.7m https://yougov.co.uk/topics/food/articles-reports/2021/05/31/what-making-flexitarians-us-and-uk-shift-towards-m https://www.ons.gov.uk/peoplepopulationandcommunity/populationandmigration/populationestimates